What if accessing government benefits and managing finances became simpler than ever? In today’s digital world, India sure has made significant strides in this direction! One amazing way is by NPCI link Bank account with Aadhaar.

This innovative process transforms how millions of Indians receive their benefits, ensuring greater transparency and efficiency in financial transactions.

Established in 2008 under the guidance of the Reserve Bank of India (RBI) and the Indian Banks' Association (IBA), the NPCI (National Payments Corporation of India) has played a crucial role in creating secure, cashless payment solutions.

By connecting Aadhaar with bank accounts, NPCI simplifies benefit disbursement and promotes financial inclusion across the country.

These initiatives are reshaping India's financial landscape, making it more accessible and transparent for all.

In this article, we’ll explore how Aadhaar npci link works, its broader implications, and what it means for India’s digital future.

What is NPCI Aadhaar Seeding?

Aadhaar seeding is the process of linking your Aadhaar number with your bank savings account and mapping it in the National Payments Corporation of India (NPCI) system.

This enables government benefits like subsidies and pensions to be credited directly to the account.

Difference Between Aadhaar Linking and Aadhaar Seeding:

India's Aadhaar system integrates with banking services through two processes: Linking and Seeding. While both connect Aadhaar numbers to savings accounts, they serve different purposes in the digital financial ecosystem. The following table outlines their key differences:

| Aspect | Aadhaar Linking | Aadhaar Seeding |

|---|---|---|

| Definition & Scope | Aadhaar card with bank account link in the bank's internal system | Link Aadhaar with NPCI along with the bank account. |

| Key Systems | Bank's core banking system | NPCI mapper (links Aadhaar to financial identifiers) |

| Purpose & Capabilities | Simplifies KYC, provides identity proof, enables basic fraud prevention | Enables direct benefit transfers, inter-bank transactions, and participation in government subsidies |

| Verification & Process | May include biometric authentication or other identity checks | Requires mapping to NPCI systems for broader financial integration |

| How many bank accounts link with Aadhaar? | Multiple linkages possible | only one savings account |

| Transaction Impact | Affects internal bank services and KYC compliance | Facilitates inter-bank transfers, digital payments, and access to government benefits |

| Suitability | For basic banking needs and identity verification | For access to digital financial services, government transfers, and wider banking capabilities |

Benefits of NPCI Link With Bank Account:

(1). Support for Government Schemes:

NPCI facilitates Direct Benefit Transfers (DBT) by linking Aadhaar numbers with bank accounts, ensuring that subsidies and welfare benefits -such as LPG subsidies, MGNREGA wages, scholarships, and maternity benefits -reach the intended recipients without the hassle of long queues and paperwork.

(2). Security and Fraud Prevention:

NPCI enhances transaction security through various mechanisms, reducing fraud risks associated with digital payments. The Aadhaar npci linking process is one such measure that helps confirm who you are.

(3). Simplified KYC Process:

The process of Know Your Customer (KYC) for opening savings accounts and availing other financial services is simplified by linking your Aadhaar to your bank account via NPCI.

(4). Biometric authentication:

In the context of the National Payments Corporation of India (NPCI) and Aadhaar-linked bank accounts, biometric authentication is a cutting-edge technology that ensures only authorized users can access their accounts.

By utilizing unique physical traits such as fingerprints or iris scans, this system verifies identities securely.

This technology allows users to perform banking activities—especially financial transactions such as cash withdrawals and deposits at Points of Sale (PoS) or micro ATMs—without the need to remember PINs or carry cards.

By integrating biometric authentication, NPCI not only bolsters security but also simplifies the overall banking process for users.

(5). Financial Inclusion:

The Aadhaar-based system allows easier access to banking services, especially for people in rural areas, and promotes a shift towards digital transactions, reducing reliance on cash.

Documents Required:

- Aadhaar.

- Bank Account Details: Your savings account number and any related information.

- Consent Form, which is available at your bank or you can download it.

How to Initiate Aadhaar Seeding:

To link Aadhaar to bank account through NPCI (National Payments Corporation of India), you have several options. Here’s a detailed overview:

Option-1: NPCI Link Aadhaar Number with Bank Account Online:

This option has several steps:

- Step-1: Go to the official NPCI portal Aadhar link section

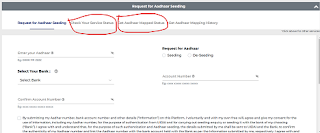

- Step-2:You can scroll the navigation menu horizontally within the red-marked circle two times.

- Step-3:After scrolling, you will see the image above. Click on the 'Know More' button, which is also highlighted in red.

- Step-4:After selecting the 'Know More' button, more options will appear. From there, click on the button labeled 'Bharat Aadhaar Seeding Enabler' (BASE).

- Step-5:Now, you can reach your desired npci bank account link destination, and according to the image above, you can send a request to the bank for seeding or deseeding your account without needing to visit the bank.

- Step-6: If you click on the "Request for Aadhaar Seeding" option, you will see three additional options which are discussed later in the Verifying "NPCI link Status" section.

Option-2: Walk into Your Bank:

To begin, you'll need to visit the nearest branch of your bank where you hold an account.

- Obtain and complete npci Aadhar link bank account form

- Sign the form and submit it at your bank branch

Option-3: Go To the Bank's online portal:

Many banks now offer digital modes for NPCI Aadhaar linking through their mobile apps and internet banking platforms, providing a convenient alternative to branch visits.

The Bank's Role in Linking Aadhaar:

Whichever method you choose bank account link with npci, the concerned bank will ultimately handle the request.

(1). Step-by-Step Aadhaar Seeding Process at Bank:

- Verification Process: The bank will verify your documents and authenticate your identity. This may involve checking your signature against their records.

- Linking Process: Once verified, the bank will link your Aadhaar number to your bank account in their Core Banking System (CBS).

- Sending Seeding Request: The next step involves the bank sending a seeding request to the NPCI mapper through batch processing or an API (application programming interface) to activate Aadhaar seeding in the bank account.

- Receiving the Response: The bank receives a response from the NPCI mapper indicating the success or failure of the seeding request.

- Handling Seeding Failures: If the "bank mapper Aadhaar" request fails, bank officials must investigate the reasons for failure.

(2). Change NPCI Bank Account Process:

If you want to seed your Aadhaar with a new bank account:

- Fill out a new consent form

- Provide the name of your previously activate npci bank account on the form

- Submit the form to your new bank

NPCI Aadhaar Link Bank Account Status Check:

Upon successful bank account npci link Aadhaar card online, your bank will send an SMS confirmation to your registered mobile number. Alternatively, you can verify the status online through NPCI or UIDAI.

(1). NPCI Website:

The "Check Your Service Status" option shows the current NPCI mapping request with your bank account, and the "Get Aadhaar Mapped Status" link shows whether your bank account was previously mapped to any bank through NPCI.

(2). UIDAI Website:

Visit the UIDAI website and use the "Bank Seeding Status" option to check which bank account is seeded with Aadhaar.

Note: Both methods require you to enter your Aadhaar number and verify with an OTP sent to your registered mobile number.

common reasons for Aadhaar seeding failures:

(1). Inactive or Dormant Account:

If the savings account you are trying to link is inactive or dormant, NPCI may reject the request.

(2). Failure to Upload to NPCI Mapper:

Even if the bank updates the customer's Aadhaar number in their Core Banking System (CBS), they must also upload this information to the NPCI mapper. If this step is not completed, the Aadhaar linking will fail.

(3). Loan Verification:

If you've got overdue loans or use an account as collateral then those may be restricted from linking.

(4). Existing Bank Not Unlink:

When you want to switch your Aadhaar linking to a new bank, your previous bank should remove your Aadhaar number from NPCI mapper records.

Resolving Seeding Issues:

The bank is responsible for managing and completing the Aadhaar seeding process.

If the Aadhaar seeding status is not reflected, branch officials should contact their designated internal departments, typically the Financial Inclusion or Technology Division, to resolve the issue.

Otherwise, the beneficiary should seek resolution through one of the grievance redressal mechanisms listed below:

- Approach the Nodal Officers of the bank for Aadhaar seeding by downloading an Excel sheet from the official portal.

- Email "npci.dbtl@npci.org.in" with the Aadhaar consent acknowledgment copy provided by the bank.

- If the issue persists, link the Aadhaar number to NPCI through India Post Payments Bank (IPPB) at the post office.

Note: In some cases, bank staff may inform you that your Aadhaar is active, but the Aadhar bank account linking status in NPCI mapper shows inactive. In such cases, you can request the bank personnel to delink Aadhaar seeding and relink it again.

Frequently Asked Questions:

(1). What should I do if my Aadhaar number is linked to an inactive or closed bank account?

Ans: There is a possibility that the bank account may be inactive; however, under no circumstances can it be closed without the beneficiary's consent.

In such cases, to remove the NPCI link, the account must first be activated, after which the process can proceed as mentioned earlier.

(2). Can I link Aadhaar to a current account used for business purposes?

Ans: No, you cannot link Aadhaar to a current account used for business purposes because such accounts are opened in the name of the business entity, while Aadhaar is issued only to individuals.

(3). Can I link my Aadhaar to a bank account in a different state or city?

Ans: Yes, You can link your Aadhaar to a bank account in any part of India. Aadhaar is accepted nationwide, so it is not restricted by where it was issued or where you currently reside.

(4). Can I do my bank account Aadhaar npci link if I have changed my name?

Ans: The bank will verify the details in your Aadhaar against your bank account information. If there is a match, the linking will be successful; otherwise, you should update your bank records to align with your Aadhaar.

(5). Can I still have my bank account link npci if my Aadhaar is suspended or inactive?

Ans: If your Aadhaar number is suspended or inactive, banks may not accept it for linking, as you cannot complete the necessary steps to associate your Aadhaar with your bank account, either online or offline.

(6). how many days does NPCI take to update an Aadhaar status with a bank?

Ans: Typically, it takes about 2-3 business days for the process to be completed.

Conclusion:

The NPCI link bank account with Aadhaar framework represents India's leap toward a unified digital financial ecosystem.

By bridging traditional banking with modern technology, it creates a seamless experience that serves everyone from urban professionals to rural citizens.

This integration continues to strengthen India's digital payment infrastructure while ensuring secure and inclusive access to financial services.